Financial Modelling Accelerator

Risk-free, rapid evaluation of cloud financial modelling using fourTheorem Accelerators.

What is Financial Modelling?

Financial modelling leverages High-Performance and High-Throughput Computing clusters operating in parallel to forecast potential outcomes, often using Monte Carlo techniques. Example applications include credit modelling, risk modelling, and predictive analytics.

Running HPC workloads on-premises presents significant challenges; long execution times, capacity planning, high TCO, maintenance burdens, and limited agility and innovation.

Benefits

Elastic Scaling

Compute resource scales on demand in line with business needs.

Unconstrained Parallel Execution

Remove resource contention issues and capacity planning.

Cost Flexibility

Gain transparent insights into costs; optimise

price/performance and only pay for what you use.

Sustainability

Reduce your carbon footprint by moving from always-on grids to compute on demand.

Reduced Code and Infrastructure

Dramatically reduced code and infrastructure means fewer bugs, less maintenance and reduced TCO.

Compliance

Reduce the effort of security and regulatory compliance by leveraging the AWS Shared Responsibility Model.

Pulse of the Future

The technology evolves with you, making obsolescence a thing of the past.

Financial Modelling Accelerator

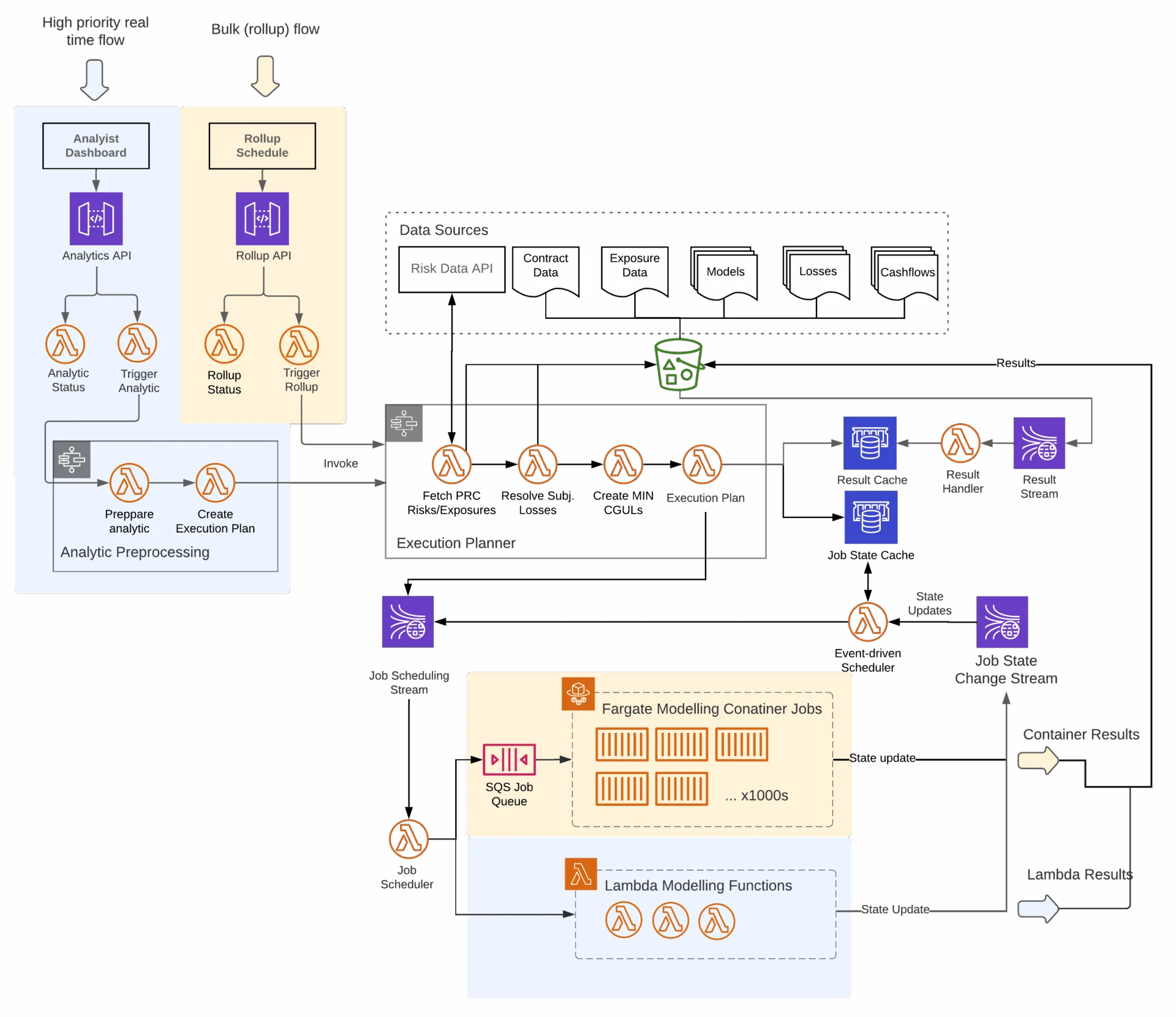

Rapidly pilot and migrate to financial modelling on AWS using our templates and expertise in services such as: AWS Lambda, AWS Fargate, Amazon ECS, Amazon EKS, AWS Batch, Amazon EC2, and Kinesis.

For Financial Services customers such as: Insurance, Banking, Investments, Capital Markets and Wealth Management

Discover

The accelerator begins with an initial discovery workshop, which typically takes one day. Following the workshop, we assess the suitability of the proposed workload, determine a scope of work, technical architecture, data security requirements and Key Performance Indicators.

Evaluate

During the evaluation phase, we migrate and modernise key elements of the workload, ensuring that the required KPIs, cost and scalability metrics are measured. This phase typically takes between 6 to 12 weeks depending on the nature of the workload and is iterative and transparent.

Report

Finally, we produce an analysis report that details the results of the accelerator, measured KPIs and a go forward plan to move the workload fully to production.

Scale Up

Post the accelerator engagement, we support the full build and scale out to production. A dedicated team is assigned full time for the duration.

Case Study

Financial Services Customer

Legacy global risk analysis platform operating on an on-premises compute grid challenged with resource contention and prolonged execution times – constraining business expansion.

The solution? Migrate to AWS to cut execution times by an order of magnitude, achieve horizontal scalability, and reduce operational expenses.